Retirement Account

We provide a variety of savings and investment strategies designed to help you achieve financial security in retirement.

Frequently Asked Questions

Learn more about the convenient services at Bank of South Texas.

-

Minimum balance requirement

You must make a minimum deposit of $100.00 to open this account.

-

Effect of Closing an IRA

If you close your account before interest is credited, you will receive the accrued interest. Other penalties will apply from the Internal Revenue Service.

-

Transaction Limitations

You may make additional contributions to this account during a term as long as you do not exceed your maximum yearly contribution.

-

Early Withdrawal Penalty

If we consent to a request for withdrawal that is otherwise not permitted you may have to pay a penalty. The penalty will be an amount equal to: Up to 1 yr. IRA - 90 days interest penalty. Over 1 yr. 183 days interest penalty.

-

Rate information

The APY (Annual Percentage Yield), assumes that interest remains on deposit until maturity. A withdrawal of interest will reduce earnings.

-

Renewal Policy

All IRAs will Automatically Renew. You will have 10 days after the maturity date to withdraw funds without a penalty.

-

Balance Computation Method

We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the principal in the account each day.

-

Compounding and Crediting

Interest will be compounded quarterly. Interest will be credited quarterly.

Features

All of our products and services come with the latest features and benefits.

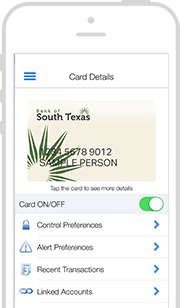

Mobile Banking

Our free Mobile Banking service makes it easy to track your spending, pay bills, send money, deposit checks, and more.

Learn More

Online Banking

Our user-friendly interface allows you to see bill payment activity, view balances, monitor transactions, and more.

Learn More

Instant Debit Card

No more waiting! Walk in to any branch to open an account and walk out with your new debit card in hand - instantly!

Learn More

ATM Services

Bank of South Texas customers can access thousands of surcharge-free ATMs worldwide thanks to our partnership with Allpoint.

Learn More

Overdraft Program

We offer a variety of overdraft protection options that can help protect you and give you financial peace of mind.

Learn More