Planning for retirement is a key step that should begin early in your career. This holds true across today’s uncertain economic landscape, with Texans facing many of the same challenges. With 57% of working Americans falling behind on retirement savings, taking control of your financial future has never been more urgent. A secure retirement starts with understanding your options and making timely, informed decisions.

Texas offers unique retirement planning opportunities that residents can leverage for long-term financial security. From occupation-specific systems like the Teacher Retirement System (TRS) and Optional Retirement Program (ORP) for educators to a wide range of employer-sponsored and individual plans, Texans have multiple avenues to grow their nest egg. Understanding these Texas-specific options can significantly influence your retirement readiness.

To make the most of these resources, consider the following core retirement planning strategies:

- Start early: The power of compound interest makes time your greatest asset. Even modest contributions can grow significantly over the decades.

- Plan strategically: Financial experts recommend targeting about 80% of your pre-retirement income to maintain your current lifestyle.

- Secure your future: A well-funded retirement account offers financial stability and gives you peace of mind and the freedom to enjoy your retirement on your own terms.

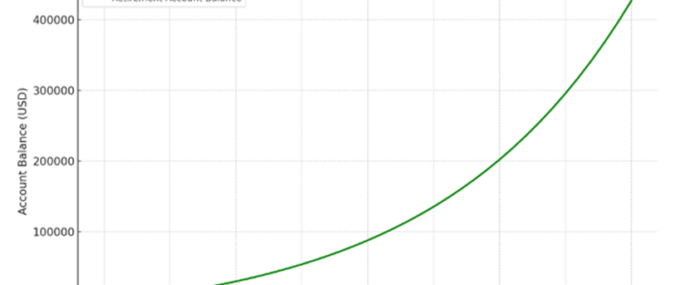

This graph illustrates the power of compound growth over a 40-year period. With consistent annual contributions and a 7% return rate, even starting with a modest amount can lead to significant long-term gains. This visual underscores why starting early is one of the most effective retirement planning strategies.

As we explore the various retirement account options available in Texas, remember that the right strategy depends on your unique situation, goals, and timeline. Taking control now, regardless of your current financial circumstances, is the first step toward unlocking a bright future.

Types of Retirement Accounts Available in Texas

- 401(k) Plans: Employer-Sponsored Options

These defined contribution plans have become increasingly prevalent, with 70% of workers having access in 2024. 401(k)s allow contributions from pre-tax wages to grow tax-free until withdrawal at retirement. Key benefits include:

- Employer matching contributions (free money toward your retirement)

- Higher contribution limits ($23,000 in 2025, with additional $7,500 catch-up for those over 50)

- Both traditional and Roth options available at many employers

- Traditional and Roth IRAs: Tax Advantages

Individual Retirement Accounts offer flexibility for all Texans with earned income:

- Traditional IRAs provide tax-deferred growth with potentially deductible contributions

- Roth IRAs offer tax-free withdrawals in retirement when funded with after-tax dollars

- 2025 contribution limit: $7,000 ($8,000 for those over 50)

- Texas-Specific Retirement Plans

Texas educators and public employees have access to specialized retirement systems:

- Teacher Retirement System (TRS): A defined benefit plan that vests after 5 years of service

- Optional Retirement Program (ORP): A 403(b) defined contribution plan for eligible higher education employees

- Texas Municipal Retirement System (TMRS): For city employees across Texas

- Texa$aver 457 Plan: Additional voluntary retirement savings option for state employees

- Self-Employed Retirement Accounts

Texas entrepreneurs and freelancers can choose from several powerful options:

- SEP IRAs: Allow contributions up to 25% of compensation or $69,000 (2025), whichever is less

- SIMPLE IRAs: Suitable for small businesses with fewer than 100 employees

- Solo 401(k)s: Offer the highest potential contributions for self-employed individuals with no employees ($70,000 in 2025)

Maximizing Your Texas Retirement Account Benefits

As a Texan, making the most of your retirement accounts requires understanding key strategies to optimize growth and minimize taxes. With the average consumer debt in Texas at $95,537 per person and more than half of Texans living paycheck to paycheck, maximizing retirement benefits is essential for long-term financial security.

- Understanding contribution limits and catch-up contributions

- For 2025, you can contribute up to $7,000 to IRAs ($8,000 if you’re over 50)

- Self-employed Texans can contribute up to $70,000 annually to Solo 401(k)s in 2025

- Texas-specific plans like TRS (Teacher Retirement System) and TDA (Tax-Deferred Account) have their own contribution structures

- If you’re 50 or older, take advantage of catch-up contributions in nearly all retirement plans

- Strategies for tax optimization with Texas retirement accounts

- Texas has no state income tax, creating unique advantages for retirement savers

- Consider the traditional vs. Roth decision based on current and expected future tax brackets

- Employer-sponsored plans like 401(k)s offer immediate tax benefits through pre-tax contributions

- Strategically withdraw from different account types in retirement to minimize tax burden

- Importance of diversification and risk management

- Spread investments across different asset classes to reduce market volatility risk

- Consider your time horizon: younger Texans can typically accept more risk for growth potential

- Review investment options from Texas-approved vendors

- Gradually shift to more conservative investments as retirement approaches

- How to avoid common mistakes in managing retirement accounts

- Don’t leave employer matching funds on the table, this is essentially free money

- Avoid early withdrawals that trigger penalties and tax consequences

- Be wary of high-fee investment options that erode returns over time

- Follow the 4% rule for sustainable withdrawals in retirement to make your savings last

Planning for a Bright Future: Steps to Take Now

Taking control of your retirement future requires more than just opening an account. It demands ongoing attention and strategic planning. Here are essential steps to ensure your Texas retirement stays on track:

- Set clear retirement goals based on your Texas lifestyle: Define what retirement looks like for you in the Lone Star State. Consider Texas’s cost of living, tax advantages, and healthcare costs. Use the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) to create concrete goals that reflect your desired lifestyle.

- Regularly review and adjust your investments: Review your retirement accounts at least annually or when experiencing major life changes. This helps ensure your investment mix still aligns with your goals and risk tolerance as market conditions evolve.

- Seek professional advice tailored to Texas: Consider consulting with financial advisors familiar with Texas-specific retirement plans. A Bank of South Texas representative can provide guidance to help determine the right investments for your future, no matter what your financial situation.

- Stay informed about legislative changes: Retirement account rules and tax laws evolve regularly. Keep abreast of changes that might affect Texas retirement accounts, contribution limits, or withdrawal requirements. This vigilance can help you maximize benefits while avoiding penalties.

Remember that retirement planning isn’t a one-time event but an ongoing process. By taking these proactive steps, you can navigate changing financial landscapes and build the secure, comfortable Texas retirement you deserve.

If you want to secure your financial future with a reliable retirement plan, contact the experts at Bank of South Texas. We offer a variety of retirement accounts tailored to help you achieve financial security in your golden years. Our representatives are ready to guide you in choosing the right investments for your unique situation, ensuring you can retire with confidence.

Explore our comprehensive range of products and services, from IRAs to CDs, designed to maximize your savings and provide peace of mind. Take the first step towards a brighter future today! Learn more about our retirement accounts.